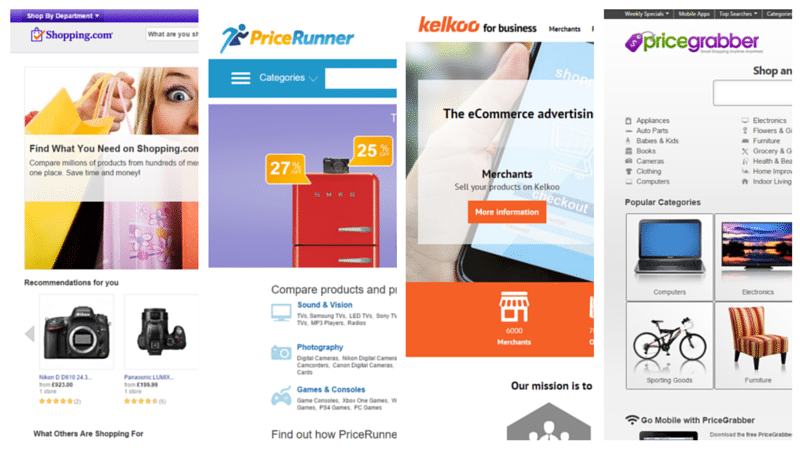

Since ushering in the internet age with gusto, the world of e-commerce has been turned upside down by the advent of price comparison websites.

Platforms that compare the price of goods and services between brands have changed the way consumers think and act; moving away from how suitable a product is to choose the best-value option instead.

Not only that, price comparison websites have been a godsend to time-wary consumers who simply don’t have the time these days to shop around and bag the perfect deal. It’s not just financial products like insurance policies and mortgages that comparison websites promote either.

There’s even price comparison platforms now that compile the best sports betting odds for all the leading sports events, from the title contenders in the English Premier League to the likely winner of the MLB World Series.

But the future for price comparison platforms looks a little less certain given that Amazon is proceeding with plans to release its own price comparison rival.

Could Amazon soon join the price comparison space?

Last summer, reports suggested that Amazon was planning its own price comparison platform by partnering with a string of leading European insurers.

It seems like a good fit for the Amazon brand which has long focused on providing a range of products for customers, as opposed to committing to goods and services from a single retailer.

Inaccuracies on price comparison websites risk losing consumer trust

An even bigger question mark was placed on the long-term future and legitimacy of price comparison websites such as Confused.com, MoneySuperMarket and GoCompare, all of whom were recently examined by Which?

In the report of its findings, Which? revealed that almost two-thirds (61%) of 79 insurance policy descriptions contained at least one discrepancy compared with the official wording in the insurer’s physical policy booklet.

Some of the errors ranged from the incorrect promise of a guaranteed courtesy car to overstating an insurer’s disability cover. Which?

stated in their report that although the comparison sites they reviewed confirmed they take measures to audit and verify policy information shown, all of the insurers refused to deny that some errors in their content slip through the net.

Maintaining customer confidence and trust will be vital for price comparison websites in the years ahead. Inaccuracies between price comparison platforms and service providers could force consumers back to buying direct from retailers instead.

Furthermore, with Amazon set to enter the price comparison picture, there is likely to be even less room for error in the near future.